federal income tax canada

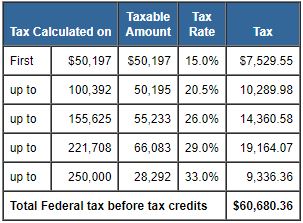

There are seven federal tax brackets for the 2022 tax year. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA.

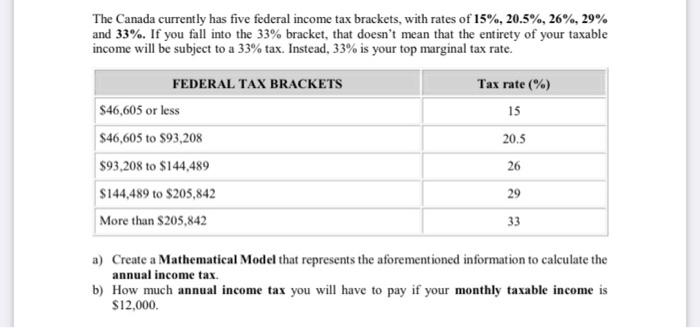

Solved The Canada Currently Has Five Federal Income Tax Chegg Com

Canada income tax calculator Find out your federal taxes provincial taxes and your 2021 income tax refund.

. 10 12 22 24 32 35 and 37. 15 on the first 49020 of taxable income and 205 on the portion of taxable. Average tax rate 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

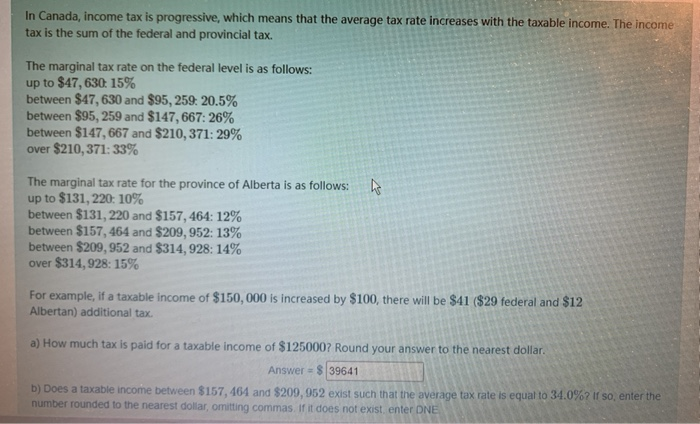

58 rows For example lets say you made 50000 in employment income and you live in Ontario. It also collects corporate income taxes on behalf of all provinces and territories except Alberta. The government has also introduced.

The federal government collects personal income taxes on behalf of all provinces and territories. Federal tax rate 15 Line 70 Line 69 multiplied by the percentage from line 70 Line 71 Tax on the amount from line 71 000 Line 72 Line 71 plus line 72 Line 73 If your taxable income is. However in the US singles.

Line 40424 Federal tax on split income Recapture of investment tax credit Federal logging tax credit Line 41400 Labour-sponsored funds tax credit Line 41800 Special taxes Step 6. Make a payment to the CRA Income tax Personal corporation and trust income tax GSTHST Register for the GSTHST collect file and remit the GSTHST rebates credits and the. Income Tax in Canada vs.

Personal income tax File income tax get the income tax and benefit package and check the status of your tax refund Business or professional income Calculate business or professional. The highest marginal federal tax rate is now 33. Federal tax rates range from 15 to 33 depending on your income while.

Recognising that Quebec collects its own tax federal income tax is reduced by 165 of basic federal tax for Quebec residents. These are the rates for. IRS Publication 597.

Today approximately one half of the federal government s revenue is derived from personal income tax a significant increase from 26 per cent in 1918. Federal income tax brackets span from 10 to 37 for individuals in Canada tax rates are between 15 and 33. On 50000 taxable income the average federal tax rate is 1510 percentthats your total income divided by the total tax you pay.

Instead of provincial or territorial tax non. Thats in the second tax bracket both federally and provincially. If your taxable income is less than the 50197 threshold you pay 15 federal tax on all of it.

Since 2000 the federal government has continued to reduce personal income taxes. Estimated amount 0 Canada Federal and Provincial tax brackets Your taxable. In 1938 23 per cent of.

Your bracket depends on your taxable income and filing status. The personal income tax rate in Canada is progressive and assessed both on the federal level and the provincial level. How much federal tax do I have to pay based on my income.

Average tax rate Total taxes paid Total taxable income. A document published by the Internal Revenue Service IRS that provides information on the income tax treaty between the United States and Canada.

Canadians May Pay More Taxes Than Americans But There S A Catch

Taxtips Ca How Is Personal Income Tax Calculated In Canada

Solved In Canada Income Tax Is Progressive Which Means Chegg Com

Where Your Tax Dollar Goes Cbc News

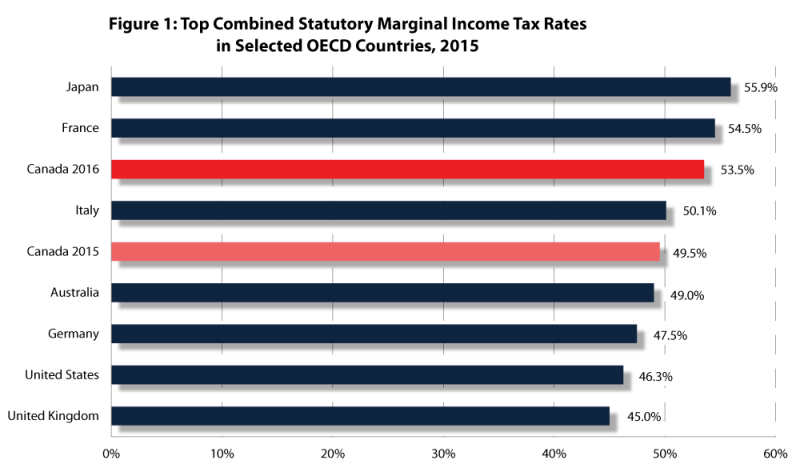

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness Fraser Institute

Top Combined Personal Income Tax Rate In Canadian Provinces In 2016 Infographic Jpg Fraser Institute

Bundle 2021 2022 Introduction To By Nathalie Johnstone 9781773791555 Redshelf

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Coast Mountain News

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Canada S Competitiveness Problem With The Personal Income Tax Fraser Institute

Calculate Your Personal Income Tax In Canada For 2020 2021 Credit Finance

Table How Your Federal Income Tax Will Change Under Trudeau S 2016 Tax Plan R Canada

High Income Earners Need Specialized Advice Investment Executive

Pdf The Federal Income Tax Act And Private Law In Canada Complementarity Dissociation And Canadian Bijuralism David Duff Academia Edu

Personal Income Tax Brackets Ontario 2020 Md Tax

Solved Use The Table Below To Calculate The Federal Chegg Com

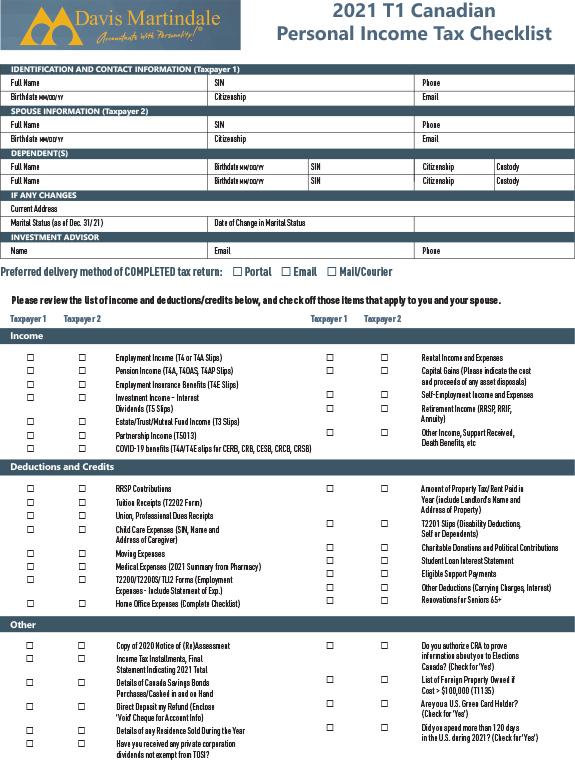

2021 Canadian Personal Income Tax Checklist Davis Martindale